Underrated Ideas Of Info About How To Become A Non Profit Church

I often get asked whether or not churches (both established and church plants) need to file with the state and the irs to become a nonprofit organization.

How to become a non profit church. The questions that follow will help you determine if an organization is eligible to apply for recognition of exemption from federal income taxation. Register your nonprofit & get access to grants reserved just for nonprofits. Form a board of directors apply for an employer identification number.

Nonprofit corporations must register and renew annually with the secretary of state corporation division. Ad microsoft is committed to helping your nonprofit organization make a greater impact. There is no need for churches to seek formal recognition.

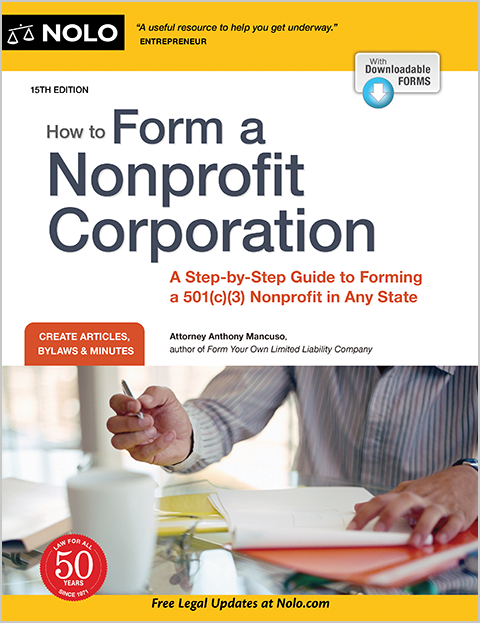

A publication describing, in question and answer format, the federal tax rules that apply to group rulings of exemption under internal revenue code section 501. There is no requirement to file form 1023, which is required to become a 501c3. Up to 25% cash back the steps for forming a religious nonprofit are similar to forming other charities, which include:

Technology solutions that are accessible and affordable for nonprofits. To register a new nonprofit corporation, use the articles of incorporation. Ad use our simple online nonprofit filing process & give your good cause a great start.

Together the directors form a board that has the overall responsibility for. Currently, all nonprofit filings will be completed. The irs automatically recognizes churches as 501 (c) (3) charitable organizations if they meet the irs requirements.

![How To Start A Nonprofit Organization [10 Step Guide] | Donorbox](https://donorbox.org/nonprofit-blog/wp-content/uploads/2020/06/Donorbox-9-1.png)

/not_for_profit_nonprofit_charity_AdobeStock_93906620-c07fd22b87c84bf28cf8b9caba9a1b67.jpeg)

![6 Types Of Fundraising Letters: Start Writing Amazing Appeals [2021 Update]](https://doublethedonation.com/wp-content/uploads/2022/06/6-types-of-fundraising-letters-for-nonprofits.png)