Amazing Tips About How To Sell A Loan Modification

The changes are made and determined by the lender.

How to sell a loan modification. How to sell a home after a loan modification. The principal owed on your home loan will always stay the same when you refinance your mortgage. Other loan terms — interest rate, length of the loan, even the loan type — can.

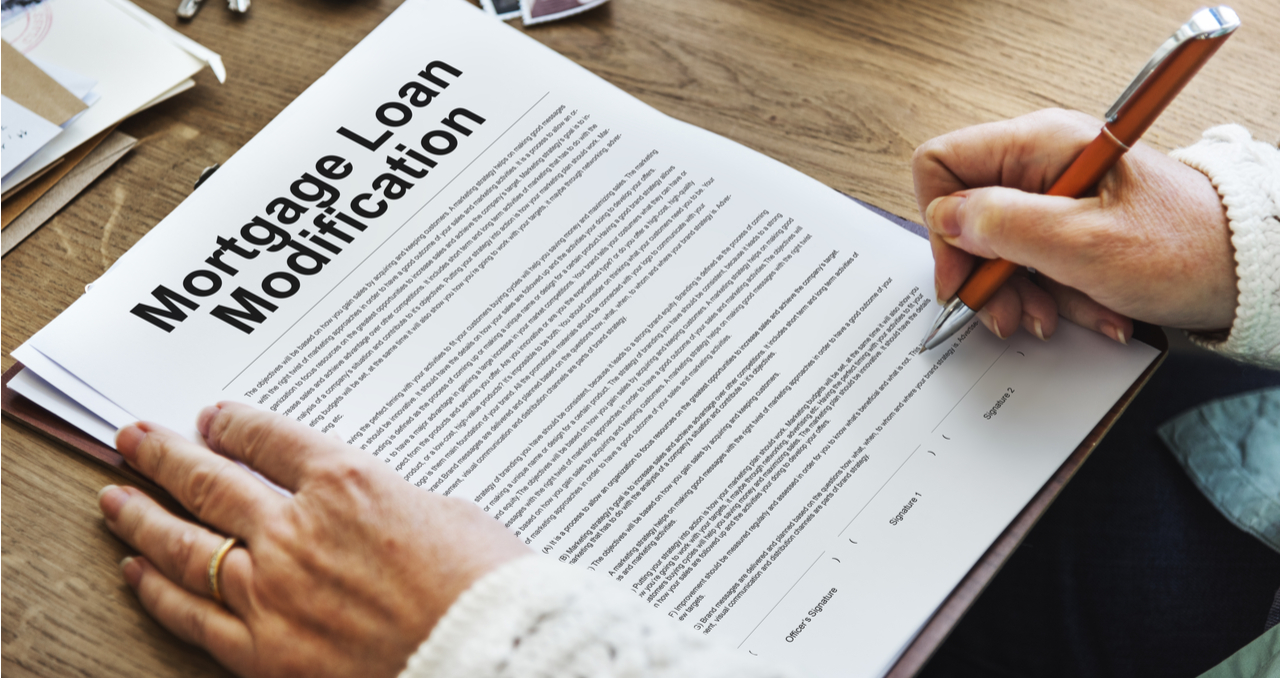

One way you can sell your house after the loan modification takes effect is potentially asking your lender for a short sale, especially if you’re still struggling to cover your monthly mortgage. Selling a house after a loan modification can get tricky if you aren't aware of the fine print. A mortgage modification is a change to the repayment terms on your existing home loan that lowers your monthly payment.

This tutorial will teach you all you need to know about selling your new york house following a loan modification if you responded yes to these questions. When your loan modification goes into effect, you don’t have to wait. A loan modification is a change made to the terms of a loan or mortgage that already exists.

If you’ve had loan modification on your mortgage, it doesn’t mean you’re stuck in. You can ask for a review of a denied loan modification if: A lender runs the numbers, including borrower income, assets, expenses and.

You can sell as soon as your loan modification goes into effect. You sent in a complete mortgage assistance application at least 90 days before your foreclosure sale; The payoff amount should reflect the total.

This mishap is becoming more common, so please share to get t. A modification is usually the preferred method of dealing with mortgage delinquency. A loan modification is a change in a borrower’s original mortgage terms that reduces the monthly payment.